Industrial-grade polymer 3D printing technologies, such as SLS, MJF, and stereolithography (SLA), are steadily advancing and continuously improving. However, FDM technology is now widely used by many companies for manufacturing end-use parts. Companies from two different sectors are beginning to show signs of direct competition in this space.

To explore the future development of industrial-grade polymer additive manufacturing in 2026, the media outlet 3DPrint conducted interviews with senior executives from key companies, including EOS, HP, Carbon, and service providers. Their insights provide significant guidance for the industry.

Fabian Alefeld, Director of Global Additive Manufacturing Business Development and Academy at EOS:

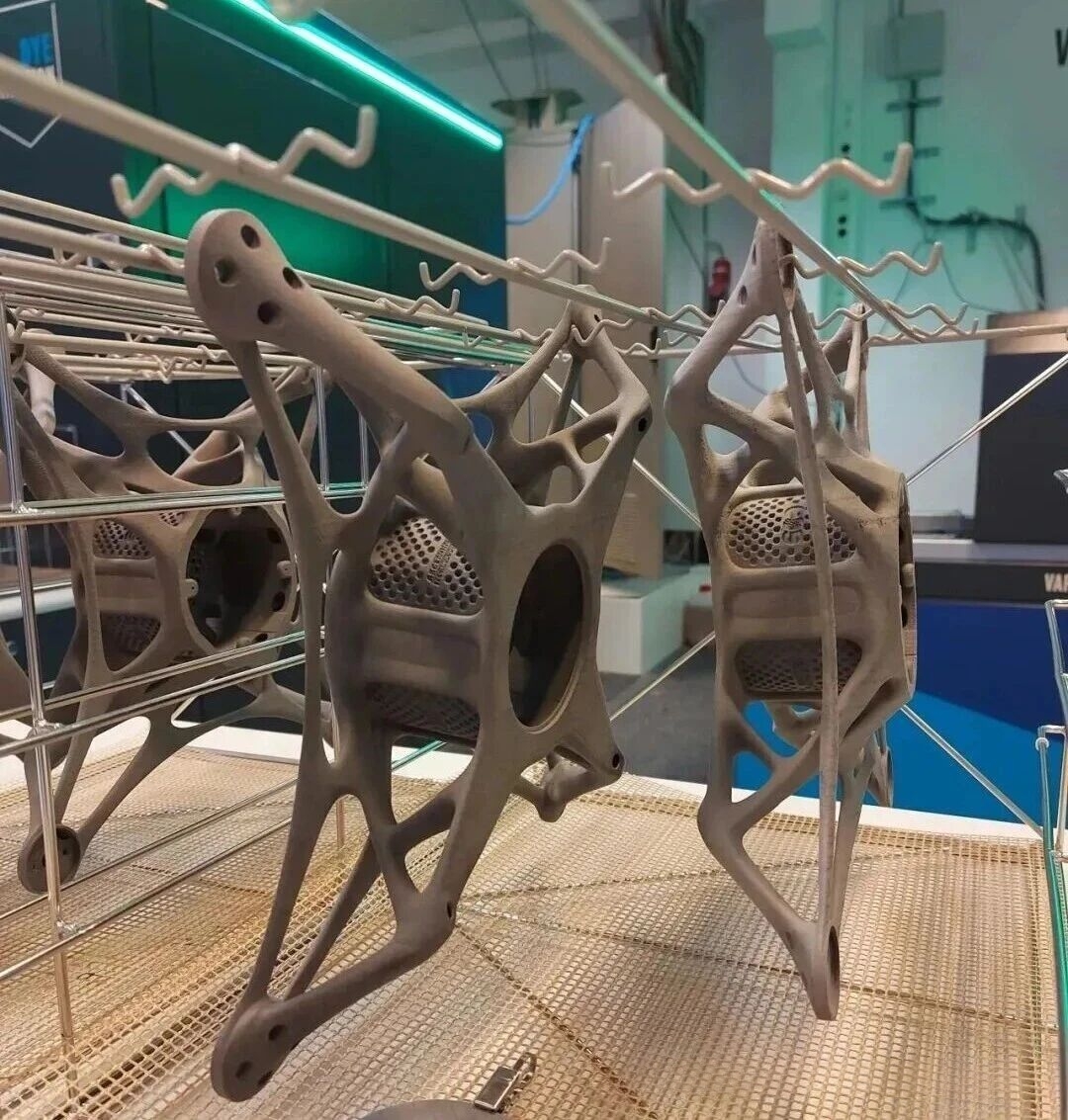

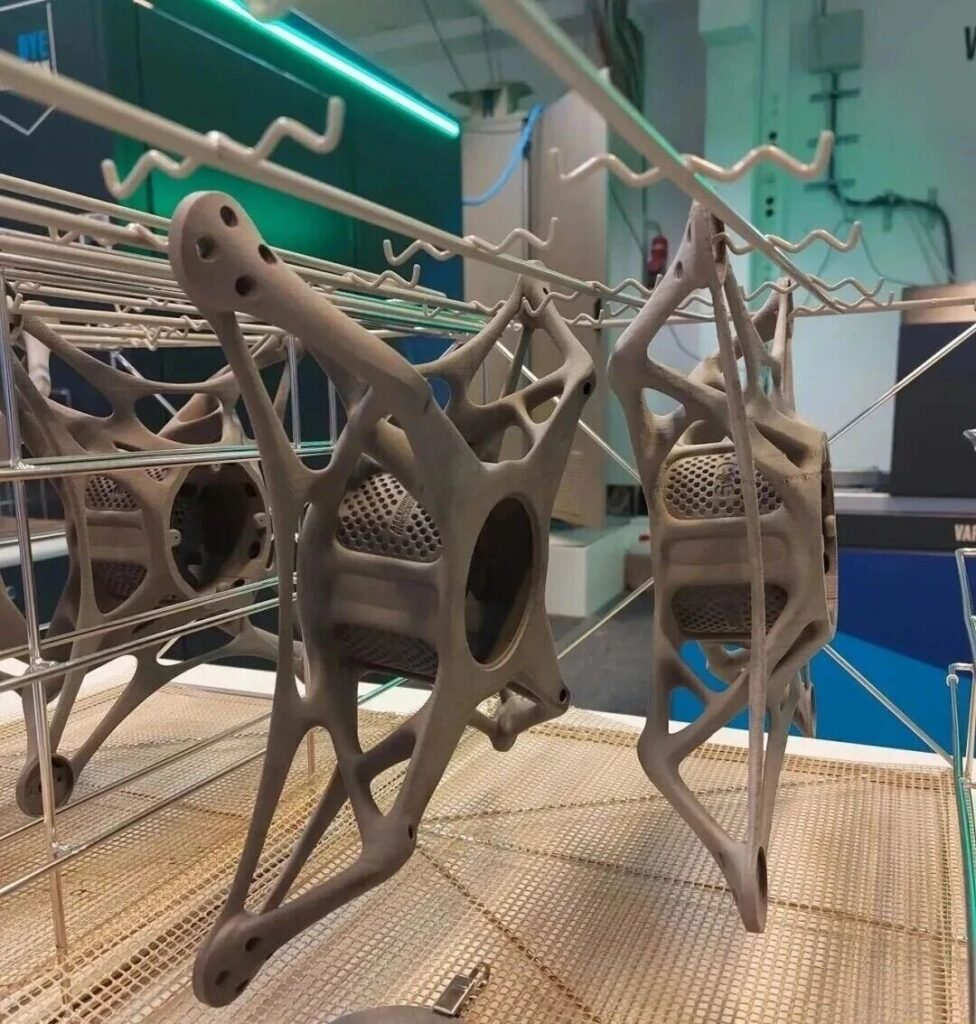

“Low-cost plastic 3D printing and industrial-grade polymer additive manufacturing will continue to evolve in different directions. For the latter, one key application area for 2026 will be high-performance applications in high-end equipment sectors. As defense and drone manufacturers scale up their projects, technologies such as Selective Laser Sintering (SLS) will see accelerated adoption—not only because they allow for scaling production, but also because they can provide the part performance needed for high-demand applications such as remote drones. Meanwhile, the overall cost will continue to decrease, and the industrial polymer sector will align with the trends in the metal industry, with growing demand for customized process parameters, specialized equipment, and engineered materials to meet highly specific application requirements.”

François Minec:

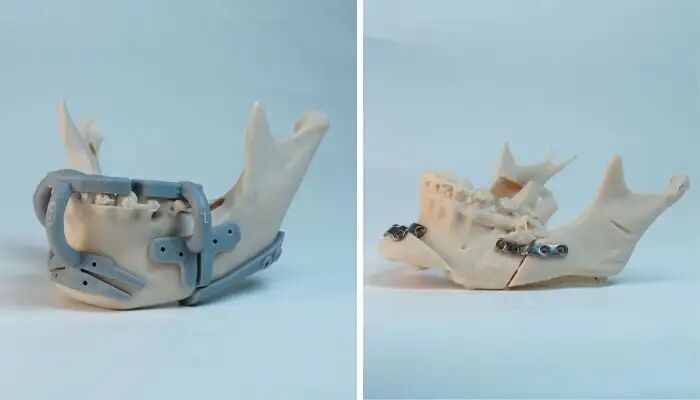

“In the coming year, the cost of powder bed 3D printed parts will continue to decrease, driving a new wave of production applications. This cost reduction comes from continuous improvements in process efficiency and material maturity. As economic benefits improve, service providers will increase their installation capacity to meet the growing demand from end customers, particularly in industries like orthotics and prosthetics, defense, and other sectors that require rapid iteration and reliable production capacity.

At the same time, we will see additive manufacturing becoming more deeply integrated into traditional supply chains. Digital inventory models and interconnected workflows—such as HP’s AMN program and our recent strategic alliance with Würth Additive Manufacturing Group—have already demonstrated their value in simplifying global operations. With the scaling of such solutions, manufacturers will be able to achieve localized production, shorten delivery cycles, and build more flexible and resilient operational systems. Together, these factors are expected to lead the industrial polymer market back to double-digit growth. The shift now is that additive manufacturing is becoming increasingly practical; large-scale production is becoming a commercially viable choice, rather than an experimental one.”

Both EOS and HP are confident about the defense and drone sectors, which may currently be the fastest-growing application for SLS technology, aside from prosthetics and orthotics. HP’s development path seems to be closely tied to digital inventory, while EOS leans more toward customizing machines for specific application scenarios. In terms of polymer powder bed 3D printing technology, these two development paths can be considered the two key directions at present.

Both of these paths can maximize the machine’s capacity, return on investment, and commercial value, and combining them is likely the most successful approach. Additionally, both companies are focused on reducing part costs, which will undoubtedly increase the chances of success.

Phil DeSimone, Chief Product Officer at Carbon:

“In 2026, additive manufacturing technology will see widespread use in the high-volume consumer goods sector, as more industries recognize the competitive advantages brought by combining additive manufacturing with advanced materials. Brands will no longer be limited to niche high-end products but will begin to introduce broader and more accessible product lines that offer higher-quality products at highly competitive prices, while still outperforming traditional products. We expect that as more brands push innovative designs to the market, the 3D printed footwear market will continue to accelerate its growth.”

Carbon is essentially playing the role of a systems integrator, combining design, software, mechanics, and materials into specific components to create high-performance products. This model has achieved significant success in fields such as bicycle saddles, military helmets, sports helmets, and backpacks. More companies should follow this model, partnering with others to become one-stop service providers in additive manufacturing, delivering faster and lower-risk solutions.

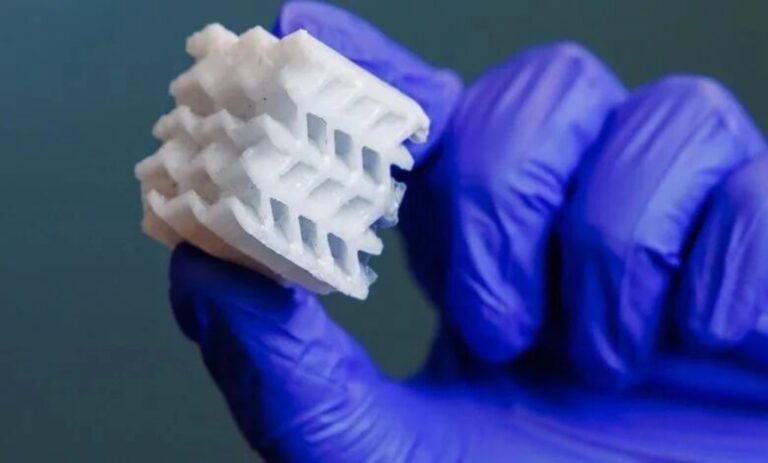

“Currently, the capacity utilization for industrial polymer additive manufacturing using Selective Laser Sintering (SLS) technology is very high. This trend will not only continue but is expected to further improve in the first half of 2026. PA12 material is very mature and remains the material of choice for functional parts. However, to achieve the appearance and feel of injection-molded parts, post-processing techniques such as dyeing and steam smoothing are increasingly being adopted.”

“In the photopolymer field, we are seeing some consolidation among large companies, which, thanks to their established brands, have earned the trust of users. Smaller, specialized suppliers are increasingly focusing on material certification to establish credentials for food contact, medical applications, flame retardancy, or toy manufacturing, and new materials are being released every month. Many resins have very low activation energies, making them usable on a variety of reasonably priced machines. If the thermal degradation of residual powder can be controlled, the adoption of SLS technology with PEEK will continue to grow. SLA and DLP parts typically do not require surface treatment, so after initially focusing on SLS and FDM, photopolymerization technologies will also see growth opportunities.”

“In summary, we must be able to combine reliability with flexibility and innovation.”

Jochen Loock, the Customer Success Manager at 3D Spark and a leader in the industrialization of additive manufacturing parts, stated:

“By 2026, it will be interesting to see how powder bed printer manufacturers respond as easy-to-use FFF printers move towards industrialization. While end-users currently have many FFF printers, they may soon reach the limits of their internal capacity or performance and turn to external suppliers. Established powder bed printer manufacturers may be reluctant to cannibalize their own business. This creates opportunities for new service providers, especially with low investment thresholds.”

This is crucial. If the service industry does not enter this field, there may be a large number of new printing farms emerging within its competitive space. These businesses typically have lower capital expenditures and offer lower unit prices for specific parts. Both the service industry and original equipment manufacturers must anticipate this future trend and develop low-cost products and services.